This post is from a suggested group

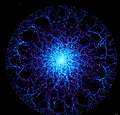

DBSCAN Anomaly

Mock DBSCAN Anomaly Indicator for Thinkorswim: Detecting HFT Irregularities and Microstructure Risks

In high-frequency markets, subtle deviations in order flow can signal manipulation (e.g., spoofing or layering by HFT algorithms) or structural risks like thin liquidity. This custom Thinkorswim indicator approximates DBSCAN clustering on a 3D feature space of normalized percent changes in price, volume, and tick count to identify anomalies in real-time.

Core Concept: DBSCAN Approximation in Trading.

DBSCAN (Density-Based Spatial Clustering of Applications with Noise) excels at isolating outliers in noisy datasets without assuming cluster shapes. Here, each bar is a point in 3D space: